In today’s fiercely competitive landscape among businesses, knowing how to do competitive analysis in B2B digital marketing is no longer an option but has become a necessity in strategic planning.

As B2B buyers become more informed and decision cycles grow more complex, understanding your competitors’ every move can mean the difference between growth and stagnation. Yet many organizations still rely on outdated, static methods that fail to capture the real-time dynamics of today’s markets.

This guide will walk you through a modern, step-by-step framework for performing a competitive analysis tailored specifically with question about How to a competitive analysis in digital marketing B2B. You’ll learn how to define clear intelligence objectives, identify direct and indirect competitors, gather insights across SEO, paid media, content, and social channels, and apply AI-powered tools to predict future trends.

By the end, you’ll have a repeatable blueprint for building a data-driven, adaptive, and globally aware B2B competitive intelligence system designed for 2025 and beyond.

1. Why your B2B competitive analysis needs a 2025 upgrade

In my decade of experience, I’ve seen countless businesses struggle with the question of how to do a competitive analysis in digital marketing b2b, often relying on outdated methods. Let me be direct: your competitors are using AI to track your every move. Are you still using spreadsheets? The game has changed, and a static, quarterly review of a few known rivals no longer provides a competitive edge. To succeed in 2025, you need a dynamic, technology-forward, and continuous approach to intelligence gathering. This guide is designed to be exactly that – a comprehensive and actionable blueprint for gaining a real-time, global advantage over your competition.

According to recent market intelligence reports, the adoption of AI in marketing is projected to grow by over 29% annually, transforming how businesses gather and interpret competitive data.

Competitive analysis vs. market research: Clarifying the B2B focus

Before we dive in, it’s crucial to clarify a common point of confusion: the difference between competitive analysis and market research. Think of it this way: market research is drawing the map of the entire country, identifying the cities, population centers, and terrain. Competitive analysis is plotting the specific, real-time routes your rivals are taking through that country. Market research is broad; it defines the ‘what’ (market size, trends) and the ‘who’ (customer personas). Competitive analysis is specific and actionable; it uncovers the ‘how’ and ‘why’ behind your competitors’ strategies. This distinction is vital in B2B, as a solid b2b market positioning analysis requires understanding both the wider landscape and the precise tactics of your opponents.

Here’s a simple breakdown I often use to illustrate the difference:

| Factor | Market Research | Competitive Analysis |

|---|---|---|

| Scope | Broad (Entire market, industry trends, customer segments) | Narrow (Specific competitors, their strategies and performance) |

| Goal | To understand the market landscape and identify opportunities | To understand competitors’ actions and find strategic advantages |

| Output | Market sizing reports, persona documents, trend analyses | SWOT analyses, feature comparisons, tactical playbooks |

2. The 2025 B2B competitive analysis framework: A step-by-step blueprint

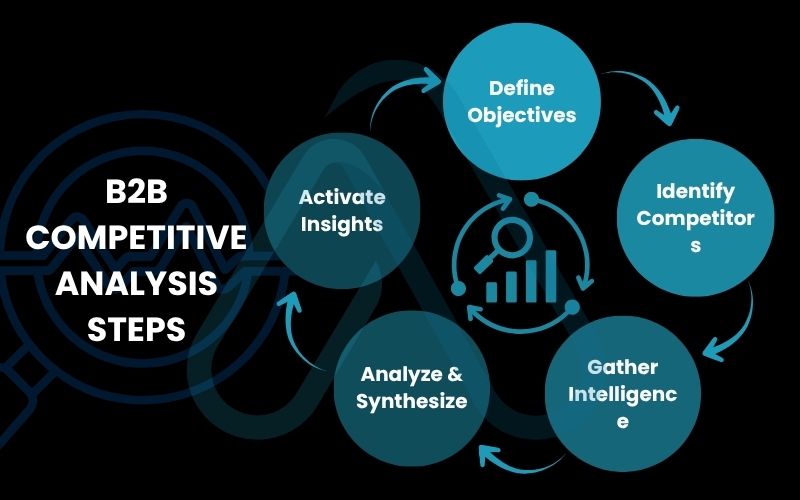

To move beyond guesswork and into strategic action, I’ve developed a modern framework designed for the complexities of the B2B digital landscape. This isn’t just a list of tasks; it’s a repeatable process that turns raw data into a decisive competitive advantage. This framework will be the core of our guide.

Here are the high-level steps we’ll walk through:

- Define Objectives: Start with the end in mind by setting clear goals and KPIs.

- Identify Competitors: Look beyond the obvious to map your entire competitive landscape.

- Gather Intelligence: Use a multi-channel approach to collect data on your rivals.

- Analyze & Synthesize: Turn data into insights using a B2B-focused SWOT analysis.

- Activate Insights: Integrate your findings directly into your marketing and sales workflows.

2.1. Defining your intelligence objectives and KPIs

The biggest mistake I see companies make is collecting data without a clear purpose. Before you even think about tools or competitors, you must define what you want to achieve. Are you trying to improve SEO rankings, increase the quality of your leads, or optimize your ad spend? Without clear KPIs, data collection is just noise. Your goal is to gather ‘intelligence’ – data with context and purpose. This process is the foundation of a solid competitive benchmarking framework.

Here are some examples of objectives and their corresponding KPIs I recommend tracking:

- For SEO: The goal is to dominate organic search. Track metrics like Organic Traffic Share (your traffic vs. theirs), Keyword Overlap & Gaps (what they rank for that you don’t), and Backlink Velocity (the rate at which they are acquiring new links).

- For Paid Media: The aim is to maximize ROAS. Monitor Impression Share (how often your ads appear vs. theirs for target keywords), CPC Benchmarks (what they’re paying for clicks), and Ad Copy Themes (the messaging and offers they are using).

- For Content Marketing: The objective is to establish thought leadership. Analyze metrics such as Top Performing Content formats (e.g., webinars, whitepapers), Social Engagement Rates, and Share of Voice (SOV) on key topics.

2.2. Identifying your complete competitive landscape

Your competitors aren’t just the companies that sell the exact same product. A thorough digital marketing competitor research process requires you to identify three distinct types of rivals in the B2B space. This broader view is critical for understanding the full spectrum of forces competing for your audience’s attention and budget.

Here’s how I categorize them:

- Direct Competitors: These are the obvious ones who offer a similar solution to the same target audience. For example, HubSpot vs. Marketo. They are competing for the same deals.

- Indirect Competitors: These companies solve the same core problem for your audience but with a different solution or a focus on a different part of the problem. For instance, if you’re HubSpot (an all-in-one platform), a specialized email marketing tool is an indirect competitor. They aren’t a 1:1 replacement, but they solve a piece of the puzzle and compete for budget and attention. You can identify indirect competitors by analyzing SERP features – who else appears for your target keywords, even if they aren’t a direct product match?

- Tertiary/Aspirational Competitors: This category is often overlooked. It includes companies or individuals who don’t sell a competing product but capture the same audience’s attention. Think of a prominent industry thought leader, a major trade publication, or a complementary software company. They compete with you for content rankings, social media mindshare, and webinar attendance. I use audience overlap tools like SparkToro to discover who else my target audience follows and trusts.

2.3. Gathering multi-channel intelligence

With your objectives defined and competitors identified, it’s time to gather the raw data. This is where a structured, multi-channel approach becomes essential. For this section on how to do a competitive analysis in digital marketing B2B, I’ll break down the process by channel, providing a repeatable template you can use.

| Category | Objective | Metrics to Track | Recommended Tools |

| SEO | Uncover your competitors’ organic search strategy to find opportunities to outrank them. | Top organic keywords, backlink profiles, domain authority trends, site speed, and structured data usage. | Ahrefs, Semrush, Moz Pro. |

| Content | Perform a competitor content strategy analysis to understand what topics, formats, and angles resonate with your shared audience. | Content-type frequency (blogs, webinars, case studies), publication velocity, social shares per post, and keyword targeting strategy. | BuzzSumo, Ahrefs’ Content Explorer, Feedly. |

| Paid Media | Analyze competitor ad campaigns to optimize your own spend, messaging, and targeting. | Ad copy, landing page design, calls-to-action (CTAs), target platforms (Google Ads, LinkedIn, etc.), and estimated monthly ad spend. | Semrush Advertising Research, SpyFu, LinkedIn Ad Library. |

| Social Media | Benchmark your social media performance and messaging against key rivals. | Follower growth rate, engagement rate (likes, comments, shares), post frequency, content mix (e.g., video vs. image), and sentiment analysis. | Sprout Social, Brandwatch, native platform analytics. |

2.4. Synthesizing data with a B2B-focused SWOT analysis

Data alone is useless. The next step is to synthesize your findings into a strategic document. I’ve found that the classic SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis is incredibly effective, but it needs to be adapted for a B2B digital marketing context. This analysis is the central output of your competitive benchmarking framework and serves as the bridge from raw data to actionable strategy.

Here’s how you can populate each quadrant with the intelligence you gathered:

- Strengths (Internal, Positive): What are you doing well compared to them? Example: ‘Our blog content generates 50% more organic traffic than our top competitor’s.’

- Weaknesses (Internal, Negative): Where are they outperforming you? Example: ‘Competitor X has 3x more positive reviews on G2 and features them prominently on their landing pages.’

- Opportunities (External, Positive): What market gaps or competitor weaknesses can you exploit? This is where strategy is born. Example: ‘Our analysis shows no competitors have published case studies in the finance vertical. We can create targeted content to dominate this niche.’

- Threats (External, Positive): What are they doing that could negatively impact your business? Example: ‘Competitor Y is bidding aggressively on our branded keywords, increasing our customer acquisition costs.’

3. AI-powered competitive intelligence tools for 2025

To truly get ahead, you need to leverage the next generation of marketing competitive analysis tools. Traditional tools are great for telling you what *has* happened. AI-powered tools are now emerging that can help predict what *will* happen. They move beyond simple data aggregation to offer predictive insights, semantic analysis, and trend forecasting. This is the core of modern b2b competitive intelligence.

Here are some of the tools I’m watching and using that are game-changers for 2025:

| Tool Name | Primary Function | Why it’s a 2025 Game-Changer |

|---|---|---|

| Crayon | Market & Competitive Intelligence | AI-powered engine tracks competitors across 100+ data types in real time, automatically surfacing key insights and trends. |

| Similarweb | Digital Market Intelligence | Goes beyond your own analytics to provide detailed traffic and engagement data for any website, revealing your competitors’ entire digital footprint. |

| AlphaSense | AI-Powered Market Research | Uses AI to scan millions of documents (earnings calls, news, reports) to find mentions and insights about competitors that you’d never find manually. |

| Contently | Content Intelligence | AI helps analyze the performance of competitor content not just by keywords, but by semantic topics, helping you predict which subject clusters to target next. |

4. Building your advanced metrics dashboard

Static reports that get filed away are useless. To make your competitive intelligence a living part of your strategy, you need a dashboard. This dashboard visualizes the KPIs you defined in step one, providing at-a-glance insights that can inform daily decisions. It is the visual representation of your competitive benchmarking framework.

Here is a blueprint for a dashboard I’d recommend building with tools like Google Data Studio, Tableau, or a specialized CI platform:

- Share of Voice (SOV) Tracker: A line graph showing your brand’s organic and paid visibility for a core set of keywords versus your top 3 competitors over time.

- Competitor Content Performance: A table that pulls in your competitors’ latest blog posts or whitepapers, along with their social share counts and estimated traffic.

- Paid Media Snapshot: A section showing your impression share vs. competitors on key paid channels, along with examples of their current ad copy.

- Competitive Index Score: This is an advanced concept I love. It’s a single, weighted metric you create by combining several key KPIs (e.g., 40% SOV + 30% backlink velocity + 30% social engagement growth). This one number gives you a high-level summary of whether competitive pressure is increasing or decreasing over time.

5. Integrating competitive intelligence with your martech stack

The final, most critical step is to make your intelligence actionable through automation. The goal is to create a true b2b competitive intelligence ecosystem where insights automatically trigger actions within your existing workflows and marketing technology (martech) stack. This moves your analysis from a passive report to an active, offensive, and defensive system.

I recommend setting up an ‘If This, Then That’ (IFTTT) system for your competitive insights. Here are some practical examples:

- IF a competitor is mentioned in the news, THEN automatically pipe that alert into a dedicated #competitive-intel Slack channel for your marketing and sales teams.

- IF a competitor launches a new high-value keyword in their Google Ads campaigns, THEN trigger an email alert to your PPC manager to analyze and counter-bid.

- IF a competitor publishes a new case study in a target vertical, THEN automatically create a task in your project management tool for Product Marketing to develop a counter-narrative or battle card.

- IF a competitor changes their pricing page, THEN trigger an email workflow to notify your Head of Sales and Head of Product immediately.

6. Creating a competitive monitoring calendar

One of the most common questions I get is, ‘How often should you conduct competitive analysis for B2B marketing?’ The answer is that it’s not a one-time event. Mature digital marketing competitor research involves both passive, automated monitoring and active, periodic deep dives. A calendar ensures this process happens consistently.

Below is a sample monitoring calendar you can adapt:

| Activity | Frequency | Owner | Tools |

|---|---|---|---|

| Automated Brand Mention Alerts | Daily | Marketing Coordinator | Google Alerts, Brandwatch |

| SERP & Keyword Ranking Checks | Weekly | SEO Manager | Ahrefs, Semrush |

| Competitor Ad Copy Review | Bi-Weekly | PPC Specialist | SpyFu, Semrush |

| Full SWOT Analysis & Report | Quarterly | Marketing Director | All of the above |

7. International considerations for multi-market B2B analysis

A huge pitfall for global B2B companies is assuming a competitor’s strategy is monolithic across all regions. A sophisticated b2b market positioning analysis must account for local nuances. What works in North America may fail in EMEA or APAC due to differences in search behavior, preferred social platforms, and cultural messaging.

Before you begin a multi-market analysis, I suggest running through this checklist:

- Are our primary US competitors the same as our primary EMEA competitors?

- How do our competitors’ pricing and product positioning change by country? (Check their country-specific websites).

- Are they using different social media platforms in different regions (e.g., Xing in Germany vs. LinkedIn in the US)?

- What do their customer reviews on local review sites say?

- Are they translating content directly or localizing it to fit cultural norms? Use geo-specific settings in your SEO tools to analyze their rankings and content country by country.

8. B2B competitive analysis case studies

Theory is great, but seeing b2b competitive intelligence in action is what truly matters. Here are a couple of condensed, realistic case studies based on projects I’ve worked on to illustrate the power of this framework.

Case Study 1: How a SaaS company uncovered a content goldmine

- Problem: A project management SaaS company was struggling to gain organic traffic against larger, more established competitors.

- Analysis: Using a competitor content analysis, they discovered that while their rivals dominated broad keywords like ‘project management software’, none of them had created in-depth content for specific methodologies like ‘agile for marketing teams’ or ‘kanban for engineering’.

- Action: They launched a pillar content series focused on these long-tail, high-intent clusters, complete with templates, webinars, and guides.

- Result: Within six months, they ranked on page one for these niche terms, leading to a +35% increase in organic demo requests from highly qualified leads.

Case Study 2: Using ad intelligence to slash acquisition costs

- Problem: A B2B cybersecurity firm saw its cost-per-click (CPC) on Google Ads rising, eroding their marketing budget.

- Analysis: A deep dive into competitor ad intelligence revealed that a new, well-funded competitor was aggressively bidding on their core keywords with a ‘free trial’ offer, something they did not have. Their own ads were focused on a ‘get a demo’ CTA.

- Action: They launched a targeted, defensive campaign with a new ‘free security audit’ offer on a dedicated landing page, specifically for the keywords where the competitor was most aggressive.

- Result: They were able to reclaim impression share, and the new offer converted at a higher rate, leading to a -20% reduction in their overall customer acquisition cost.

9. FAQs about competitive analysis in digital marketing B2B

What are the most critical metrics to track in a B2B competitive analysis?

The most critical metrics to track in B2B competitive analysis include:

- Traffic & Visibility: Share of Voice (SOV), organic keyword rankings, backlink growth.

- Engagement & Messaging: Social media engagement rates, top content formats, ad copy themes.

- Conversion & Lead Gen: Calls-to-action (CTAs), landing page offers, and user reviews.

Focus on these areas to assess market presence and effectiveness!

How can a small B2B business conduct competitive analysis on a tight budget?

A small B2B business can conduct budget-friendly competitive analysis by:

- Google Alerts for competitor updates.

- Similarweb (Free Version) for traffic insights.

- Social Media Ad Libraries to view active ads.

- Manual Research through newsletters and reviews.

Is it ethical to analyze my competitors’ digital marketing?

Yes, it is ethical to analyze competitors’ digital marketing as long as you use publicly available data. This practice helps inform your business strategy and strengthens the market without engaging in illegal activities.

Glossary of key terms

| Abbreviation | Full Term | Meaning |

|---|---|---|

| AI | Artificial Intelligence | The simulation of human intelligence in machines, used in marketing to analyze data and predict trends. |

| SEO | Search Engine Optimization | The practice of increasing the quantity and quality of traffic to your website through organic search engine results. |

| SERP | Search Engine Results Page | The page displayed by a search engine in response to a query from a user. |

| LSI | Latent Semantic Indexing | A concept search engines use to discover how terms and concepts are related, used to identify related keywords. |

| KPI | Key Performance Indicator | A measurable value that demonstrates how effectively a company is achieving key business objectives. |

| CPC | Cost Per Click | An online advertising model used to drive traffic to websites, in which an advertiser pays a publisher when the ad is clicked. |

| SWOT | Strengths, Weaknesses, Opportunities, Threats | A strategic planning framework used to evaluate a company’s competitive position. |

| SOV | Share of Voice | A measure of the market your brand owns compared to your competitors. It acts as a gauge for your brand’s visibility. |

| Martech | Marketing Technology | The range of software and tools that marketers use to plan, execute, and measure campaigns. |

| SaaS | Software as a Service | A software licensing and delivery model in which software is licensed on a subscription basis and is centrally hosted. |

| EMEA | Europe, the Middle East, and Africa | A common geographical designation for business and marketing purposes. |

10. Final thoughts

As we’ve seen, a modern, technology-forward approach to competitive analysis is no longer a ‘nice-to-have’ – it’s a fundamental requirement for B2B survival and growth in 2025. By moving away from static spreadsheets and embracing a dynamic, automated framework, you can turn competitive analysis from a reactive chore into a proactive strategic weapon.

I’ve walked you through my entire process, but the key is to start. Here are the most critical takeaways:

- Start with Why: Define your objectives and KPIs before you do anything else. Intelligence without purpose is just noise.

- Look Broader: Your competitors are not just those who sell the same product. Identify and track direct, indirect, and tertiary rivals.

- Embrace Technology: Leverage modern, AI-powered tools to automate data gathering and uncover predictive insights that manual analysis will miss.

- Activate Your Data: The ultimate goal is action. Integrate your findings into your martech stack to create an automated, living intelligence system.

Your journey begins with a single step. Start today by identifying your top three competitors and setting up a simple automated alert for their brand mentions. That one action will put you on the path to building a sustainable competitive edge. For more in-depth guides on leveraging technology for business growth, explore our Digital Marketing Strategies categories on Afdevinfo.